“Yes Bank Surges 8% on Stellar Q4 Results: A Closer Look at the Financial Revival”

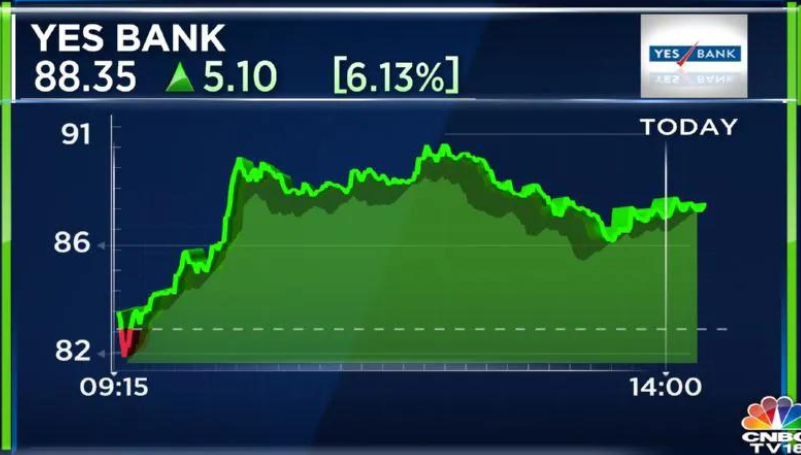

Yes Bank, one of India’s leading private sector banks, recently made headlines with an impressive 8% rise in its share price after releasing strong Q4 results for the year 2024. This surge signals a significant turnaround for the bank, which has been working diligently towards financial improvement amid challenging times. Let’s take a deeper look at the factors behind Yes Bank’s resurgence and what it means for investors.

The Resilient Recovery

Yes Bank’s journey over the last few years has been no less than a roller coaster ride. From facing a liquidity crunch to restructuring under new leadership, the bank has weathered turbulence to emerge stronger. The latest surge in its share price is a testament to its resilience and strategic revival efforts.

Strong Q4 Performance

The highlight of Yes Bank’s recent success story is undoubtedly its stellar performance in Q4 2024. The bank reported strong earnings, exceeding market expectations and building confidence among investors. Key financial indicators such as net profit, asset quality and provisions have shown significant improvement, reflecting the effectiveness of the bank’s turnaround strategy.

Strategic Initiatives Paying Off

Under the leadership of its new management team, Yes Bank has launched a series of strategic initiatives aimed at strengthening its core operations, enhancing digital capabilities and redefining its market position. These efforts have begun to bear fruit, as evidenced by the positive momentum seen in its financial performance and investor sentiment.

Regulatory Compliance and Governance:

One of the important aspects that has contributed to the revival of Yes Bank has been its unwavering commitment towards regulatory compliance and corporate governance standards. The Bank has implemented stringent measures to address past shortcomings and restore confidence among stakeholders, thereby strengthening its credibility in the market.

Outlook and Future Prospects

Looking to the future, Yes Bank is poised for further growth and consolidation as it continues to execute its strategic roadmap. With a renewed focus on customer-centricity, innovation and risk management, the Bank is well positioned to capitalize on the emerging opportunities in India’s dynamic banking landscape.

Yes Bank’s remarkable turnaround journey and the recent surge in its share price underlines the Bank’s resilience and determination to regain its lost glory. Although challenges may remain, the positive trajectory demonstrated by Yes Bank bodes well for its stakeholders and reaffirms confidence in its future prospects. As the bank continues to chart its path towards sustainable growth, investors can consider Yes Bank as a potential candidate for their investment portfolio, albeit with due diligence and a long-term perspective.

By closely monitoring the progress of Yes Bank and staying connected with the market dynamics, investors can position themselves to take advantage of the bank’s resurgence and participate in India’s emerging banking sector scenario.